Quess Corp Share Price Target: Quess Corp is a leading business services provider in India, offering a wide range of solutions, including staffing, IT services, facility management, and more. Known for its innovative approach and diverse service offerings, Quess Corp has established itself as a key player in its sector.

This detailed article provides insights into Quess Corp’s market performance, share price targets for 2025 to 2030, and other critical financial and strategic factors.

Table of Contents

Quess Corp: Market Overview

| Parameter | Value |

|---|---|

| P/E Ratio | 25.89 |

| Dividend Yield | 1.64% |

| 52-Week High | ₹875.00 |

| 52-Week Low | ₹459.50 |

| Market Cap | ₹9.07KCr |

| Face Value | ₹10 |

Quess Corp Share Price Chart

The following chart represents the historical trends in Quess Corp’s share prices over the past year:

Quess Corp Share Price Target 2025 to 2030

| Year | Expected Share Price Target (₹) |

|---|---|

| 2025 | ₹699.93 |

| 2026 | ₹775.00 |

| 2027 | ₹840.00 |

| 2028 | ₹900.00 |

| 2029 | ₹960.00 |

| 2030 | ₹1020.00 |

Quess Corp Share Price Target Each Year:

Share Price Target

Quess Corp Share Price Target 2025:

In 2025, Quess Corp’s share price is expected to reach around ₹699.93. This projection is based on the company’s strong market position in the workforce solutions industry and its consistent performance. With the anticipated growth in demand for staffing and business solutions, Quess Corp is likely to benefit from favorable market conditions. Additionally, positive macroeconomic factors and industry trends are expected to support this upward trajectory.

Quess Corp Share Price Target 2026

By 2026, Quess Corp’s share price is projected to rise to approximately ₹775.00. This increase can be attributed to the company’s continued expansion and innovation in its service offerings. As Quess Corp adapts to evolving market demands and technological advancements, it is expected to attract more clients and generate higher revenues. The overall positive sentiment in the stock market and investor confidence in the company’s growth potential will also play a crucial role in this price target.

Quess Corp Share Price Target 2027

In 2027, Quess Corp’s share price is forecasted to reach around ₹840.00. This projection takes into account the company’s strategic initiatives and its ability to capitalize on emerging opportunities in the staffing and employment services sector. With a focus on enhancing operational efficiency and expanding its client base, Quess Corp is expected to achieve steady growth. The supportive economic environment and favorable industry trends will further contribute to this upward movement in share price.

Quess Corp Share Price Target 2028

By 2028, Quess Corp’s share price is anticipated to climb to approximately ₹900.00. This increase will be driven by the company’s continued innovation and its ability to meet the evolving needs of its clients. As Quess Corp strengthens its market position and expands its service offerings, it is likely to attract more business and generate higher revenues. The positive market sentiment and investor confidence in the company’s long-term growth potential will also play a significant role in this price target.

Quess Corp Share Price Target 2029

In 2029, Quess Corp’s share price is expected to reach around ₹960.00. This projection is based on the company’s sustained growth and its ability to adapt to changing market dynamics. With a focus on operational excellence and client satisfaction, Quess Corp is likely to continue its upward trajectory. The supportive economic environment and favorable industry trends will further contribute to this price target.

Quess Corp Share Price Target 2030

By 2030, Quess Corp’s share price is forecasted to reach approximately ₹1020.00. This projection takes into account the company’s strategic initiatives and its ability to capitalize on emerging opportunities in the staffing and employment services sector. With a focus on enhancing operational efficiency and expanding its client base, Quess Corp is expected to achieve steady growth. The supportive economic environment and favorable industry trends will further contribute to this upward movement in share price.

Shareholding Pattern of Quess Corp

| Category | Percentage |

| Promoters | 56.57% |

| DII | 10.44% |

| Foreign Institutional Investors (FII) | 15.24% |

| Public | 17.74% |

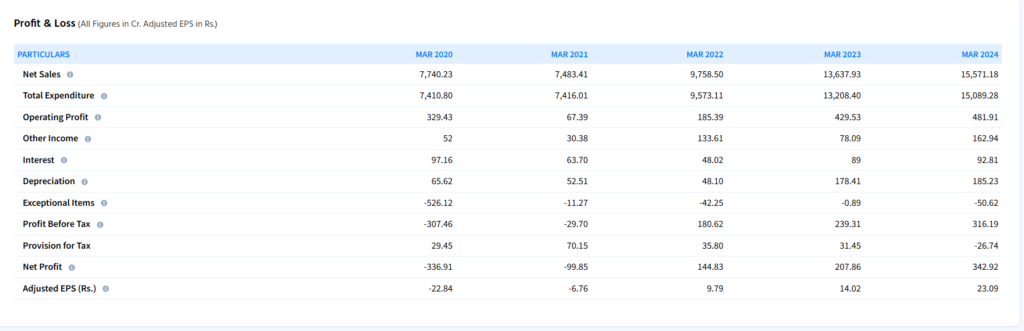

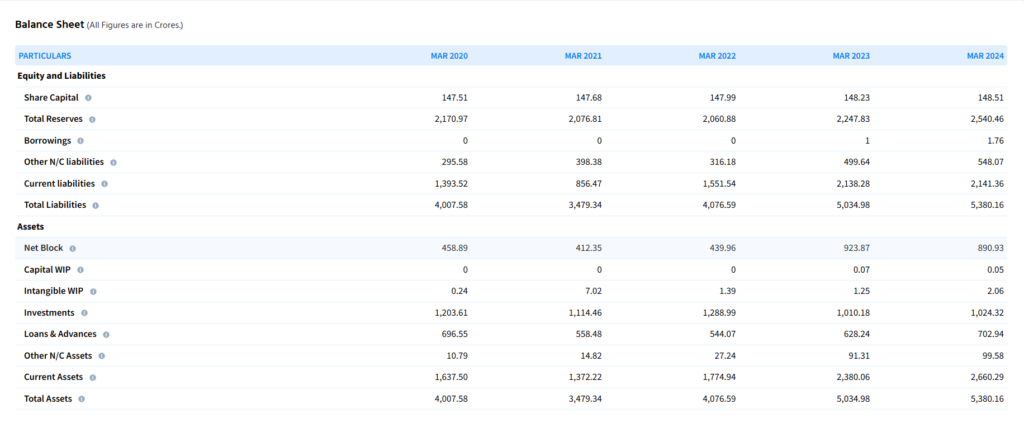

Quess Corp Financials:

P&L:

Balance Sheet:

Why is Quess Corp Share Falling?

Quess Corp shares have been underperforming recently due to a combination of factors, including a decline in operating profits and bearish market trends. The stock has also been trading below key moving averages, which has contributed to its downward trend.

Is Quess Corp a Good Buy?

Whether Quess Corp is a good buy depends on your investment goals and risk tolerance. The stock has shown strong growth potential in the past, but it’s currently facing some challenges. Analysts have mixed opinions, with some recommending a buy and others suggesting caution.

Quess Corp Share Price 52 Week Low:

The 52-week low for Quess Corp shares is ₹459.50.

Quess Corp Share Price 52 Week High:

The 52-week high for Quess Corp shares is ₹875.00.