waaree renewables share price target 2025 to 2030: Waaree Renewables has emerged as a significant player in the renewable energy sector, capturing investor attention with its innovative approach and steady growth. As global demand for clean energy continues to rise, Waaree Renewables stands poised to capitalize on this trend, making its stock a hot topic among investors. In this article, we will explore the projected share price targets for Waaree Renewables from 2025 to 2030, backed by market analysis, industry trends, and company performance. Whether you’re a seasoned investor or new to the stock market, this detailed forecast will help you make informed decisions about this promising renewable energy company.

Table of Contents

Current Financial Snapshot for Waaree Renewables Share Price:

| Metric | Value | Year-on-Year (YoY) Change |

|---|---|---|

| Revenue | ₹8.76 Billion | +149.73% |

| Operating Expense | ₹296.30 Million | +72.18% |

| Net Income | ₹1.48 Billion | +167.27% |

| Net Profit Margin | 16.90% | +7.03% |

| EBITDA | ₹2.07 Billion | +147.92% |

| Effective Tax Rate | 25.39% | N/A |

| 52-Week High | ₹3,037.75 | N/A |

| 52-Week Low | ₹268.10 | N/A |

| Current Market Price | ₹1,415.00 | N/A |

| Day’s High | ₹1,466.45 | N/A |

| Day’s Low | ₹1,378.65 | N/A |

| Market Capitalization | ₹14,560 Crores | N/A |

Shareholding Pattern of Waaree Renewables

The shareholding pattern of Waaree Renewables provides insights into the distribution of equity among various stakeholders.

| Category | Percentage (%) | Remarks |

|---|---|---|

| Promoters | 74.46% | Strong insider confidence in the business’s future |

| Retail and Others | 24.70% | Significant holding by individual and retail investors |

| Foreign Institutions (FII/FPI) | 0.83% | Modest participation by foreign institutional investors |

| Other Domestic Institutions | 0.01% | Minimal holding by domestic institutional investors |

The high promoter holding of 74.46% reflects strong insider confidence in the company’s future. Retail and individual investors collectively hold 24.70% of the shares, while foreign institutional investment remains relatively modest at 0.83%. This distribution highlights a company with substantial internal ownership and growing interest from institutional investors.

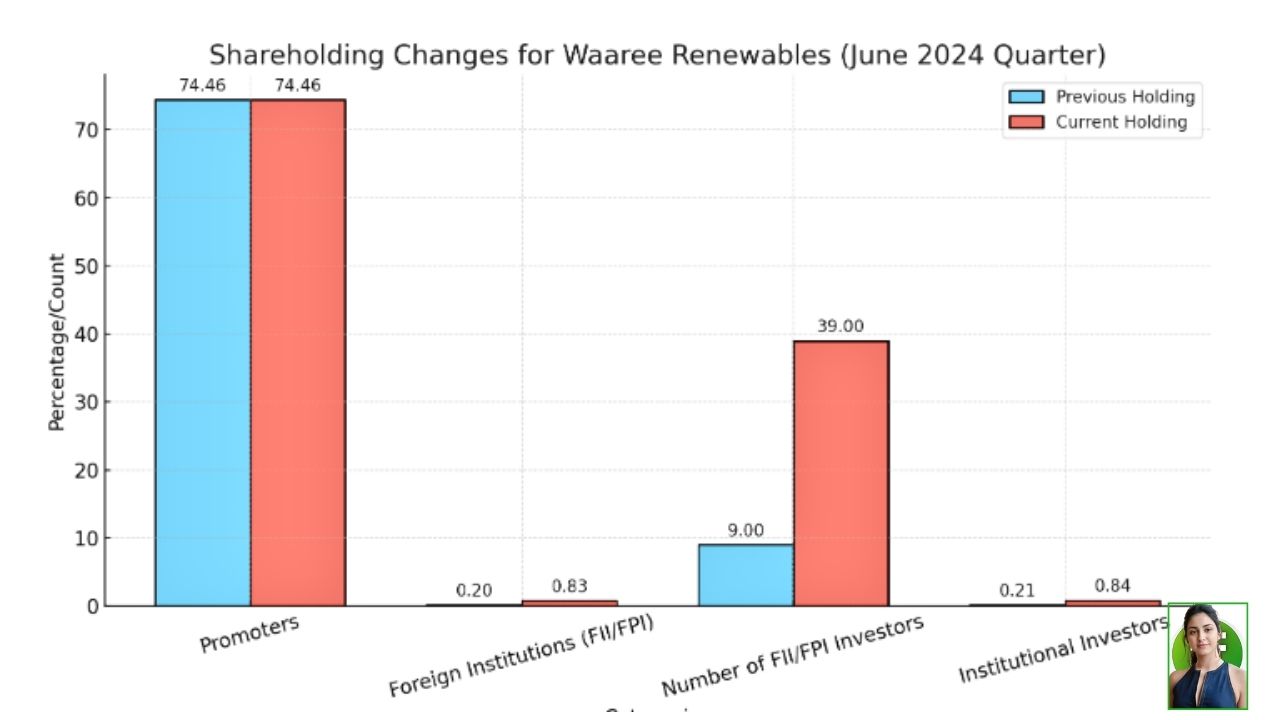

Changes of Shareholding From IPO in waaree renewables:

| Category | Previous Holding | Current Holding |

|---|---|---|

| Promoters | 74.46% | 74.46% |

| Foreign Institutions (FII/FPI) | 0.20% | 0.83% |

| Number of FII/FPI Investors | 9 | 39 |

| Institutional Investors | 0.21% | 0.84% |

waaree renewables share price target 2025 to 2030

| Year | 1st Target (INR) | 2nd Target (INR) |

|---|---|---|

| 2025 | 1,800 | 2,500 |

| 2026 | 2,000 | 2,800 |

| 2027 | 2,300 | 3,200 |

| 2028 | 2,500 | 3,500 |

| 2029 | 2,800 | 4,000 |

| 2030 | 3,000 | 4,500 |

This table represents the expected range of Waaree Renewables’ share price over the next five years, reflecting potential market trends andgrowth estimates. The low target represents a conservative estimate, while the high target accounts for optimistic growth and market conditions.

waaree renewables share Price Target 2025

(Low: INR 1,800, High: INR 2,500)

In 2025, Waaree Renewables is expected to witness significant growth as the company strengthens its position in the renewable energy sector. The low target of INR 1,800 reflects moderate market conditions and steady operational performance, driven by increasing demand for clean energy solutions. On the other hand, the high target of INR 2,500 accounts for more aggressive expansion, driven by an increase in renewable energy adoption, government incentives, and successful project completions.

waaree renewables share Price Target 2026

(Low: INR 2,000, High: INR 2,800)

By 2026, Waaree Renewables is likely to experience continued growth due to the scaling up of its operations. The low target of INR 2,000 reflects a solid but cautious market sentiment, with expected challenges in the form of global economic factors and competition. The high target of INR 2,800 represents a more optimistic scenario, where Waaree successfully taps into new markets and further establishes itself as a leader in the solar and renewables space.

waaree renewables share Price Target 2027

(Low: INR 2,300, High: INR 3,200)

In 2027, Waaree Renewables’ share price could rise substantially as the company benefits from the expansion of renewable energy adoption across India and globally. The low target of INR 2,300 reflects a stable market environment, while the high target of INR 3,200 factors in aggressive growth, potential international expansions, and favorable regulatory conditions that encourage more investment in the renewable energy sector.

waaree renewables share Price Target 2028

(Low: INR 2,500, High: INR 3,500)

By 2028, Waaree Renewables is expected to become a more dominant player in the industry, with greater diversification in its renewable energy portfolio. The low target of INR 2,500 assumes the company will continue to deliver solid results in the face of market fluctuations. The high target of INR 3,500 reflects the company’s potential for large-scale project completions, global market reach, and advancements in energy technology, positioning Waaree as a key global player.

waaree renewables share Price Target 2029

(Low: INR 2,800, High: INR 4,000)

In 2029, Waaree Renewables could see its stock rise significantly due to ongoing international market penetration and high investor confidence in the future of renewable energy. The low target of INR 2,800 reflects steady growth, while the high target of INR 4,000 reflects expectations of breakthrough technological innovations, increased demand for renewable energy, and favorable government policies driving further investments in solar power projects.

waaree renewables share Price Target 2030

(Low: INR 3,000, High: INR 4,500)

By 2030, Waaree Renewables is expected to be a major force in the global renewable energy market. The low target of INR 3,000 assumes the company’s continued growth trajectory, with substantial market share in the solar and renewable sectors. The high target of INR 4,500 accounts for the company’s potential leadership position in the industry, scaling up to new markets, and capitalizing on future renewable energy trends, which will likely drive the stock to new heights.

Influencing Factors for Waaree Renewables Share Price

The share price of Waaree Renewables, like any publicly traded company, will be influenced by a variety of factors. These factors can be broadly categorized into external market forces, company-specific factors, and industry-related factors. Here’s a breakdown:

1. Market and Economic Conditions

- Economic Growth: The overall economic growth in India and global markets will significantly impact Waaree’s performance. In a growing economy, demand for renewable energy increases, potentially boosting the company’s revenues and share price.

- Inflation and Interest Rates: Rising inflation or increasing interest rates could impact the company’s cost of capital and profitability, potentially leading to a lower share price.

- Global Economic Stability: Global economic conditions, especially in key markets like the U.S. and Europe, can affect investor confidence and demand for renewable energy.

2. Government Policies and Regulations

- Government Incentives for Renewable Energy: The Indian government’s policies and incentives towards renewable energy, such as subsidies, tax breaks, or mandates for clean energy usage, can have a major impact on Waaree Renewables’ growth and profitability. Strong government backing could positively influence the share price.

- Regulatory Changes: Any changes in energy policies, regulations regarding environmental standards, or renewable energy mandates can either benefit or hinder Waaree’s operations and, consequently, its stock price.

3. Industry Trends and Competition

- Growth of Renewable Energy: As the demand for renewable energy increases globally, companies like Waaree Renewables will benefit from this shift. Positive industry trends toward clean energy adoption can push share prices higher.

- Competition: The competitive landscape in the renewable energy sector, including new entrants and technological advancements, can affect Waaree’s market share and pricing power. If competitors innovate faster or offer better solutions, it may hurt Waaree’s market position and share price.

- Technological Advancements: Advancements in solar technology, energy storage solutions, or energy efficiency could either create new opportunities for Waaree or render its existing solutions obsolete, directly impacting the share price.

4. Financial Performance

- Revenue and Profit Growth: Strong financial results, including growth in revenue, profitability, and margins, will positively influence investor sentiment and, therefore, the stock price. If Waaree consistently outperforms earnings expectations, it will likely see an increase in share price.

- Debt Levels: High levels of debt can be a red flag for investors, potentially reducing investor confidence. Waaree’s ability to manage debt and its overall financial health will significantly affect its stock performance.

- EBITDA and Earnings Per Share (EPS): Investors closely monitor Waaree’s EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and EPS (Earnings Per Share). Strong performance in these areas is a key indicator of financial health and profitability, positively influencing share price.

5. Investor Sentiment and Market Perception

- Market Sentiment: General market sentiment towards renewable energy companies and green investments can have a significant impact on Waaree’s share price. A strong appetite for sustainable investments will likely push stock prices higher.

- Media and Analyst Opinions: Positive news, analyst upgrades, or media coverage can boost investor confidence, while negative coverage or analyst downgrades can lead to a decline in the share price.

- Foreign Institutional Investment (FII/FPI): Increasing interest from foreign institutional investors, as seen with Waaree Renewables, can drive up the stock price as these investors bring capital and market confidence into the company.

6. Operational Efficiency and Growth Initiatives

- Project Execution: Waaree’s ability to execute large-scale projects and expand its renewable energy footprint efficiently will affect future earnings potential and share price.

- Partnerships and Collaborations: Strategic partnerships, joint ventures, or collaborations with other players in the energy sector can create growth opportunities for Waaree, positively influencing its stock price.

- Expansion into New Markets: Waaree’s ability to expand internationally or into new geographical regions will drive growth and, in turn, have a positive impact on the share price.

7. External Factors

- Geopolitical Events: Geopolitical risks, such as trade tensions, conflicts, or policy changes in key markets, can have an indirect effect on Waaree’s business and stock price.

- Natural Disasters and Climate Events: Renewable energy companies, particularly those in solar energy, may be affected by extreme weather events or natural disasters that disrupt operations or damage infrastructure, potentially impacting their stock price.

In summary, the share price of Waaree Renewables will be influenced by a mix of market conditions, government policies, technological advancements, financial performance, and investor sentiment. Positive developments in these areas will likely lead to a higher stock price, while negative developments could have the opposite effect.

Disclaimer:

The information provided in this article is for informational purposes only and should not be construed as financial advice or a recommendation to buy or sell securities. The content is based on publicly available information, and while we strive to ensure accuracy, we do not guarantee the completeness or correctness of any information provided.

Investing in stocks involves risk, and you should conduct your own research or consult with a qualified financial advisor before making any investment decisions. The stock market is subject to fluctuations, and past performance is not indicative of future results.

We are not responsible for any investment decisions made based on the information provided in this article. All opinions expressed are solely those of the author(s), and we encourage you to verify any information independently before making any financial decisions.

Why are Waaree Renewables falling?

Waaree Renewables’ stock price could be falling due to several factors including market conditions, investor sentiment, financial performance, or regulatory challenges. Negative news related to the company or the renewable energy sector, competition, or broader economic factors could also contribute to the decline.

Are Waaree Energies and Waaree Renewables the same?

Yes, Waaree Energies and Waaree Renewables are part of the same group, but they focus on different aspects of the renewable energy industry. Waaree Renewables deals with solar power and renewable energy solutions, while Waaree Energies primarily focuses on the manufacturing of solar panels and other solar-related products.

Can I buy Waaree Renewables share?

Yes, you can buy Waaree Renewables shares on the stock exchange (NSE or BSE) through a registered stockbroker or an online trading platform. Ensure you have a Demat and trading account to buy and sell stocks.

What does Waaree Renewables do?

Waaree Renewables is involved in the renewable energy sector, primarily focusing on solar energy. The company designs, manufactures, and installs solar power systems and solutions, catering to both residential and industrial needs.

Why is Waaree Renewables share price increasing?

The share price of Waaree Renewables may increase due to a positive outlook in the renewable energy sector, increasing government support for solar power, successful business strategies, and the company’s strong financial performance. Growing demand for solar energy and advancements in technology could also play a significant role.

Why is Waaree Renewables share price going down?

If the share price of Waaree Renewables is declining, it could be due to a variety of reasons, such as a poor earnings report, lower-than-expected revenue or profits, competition, regulatory challenges, or negative news impacting the renewable energy sector. Investors may also react to broader market conditions or macroeconomic factors.

Why is Waaree Renewables share price increasing?

The share price of Waaree Renewables could be increasing due to positive developments, such as strong financial results, successful implementation of large solar projects, favorable government policies, or a growing demand for renewable energy solutions. Additionally, positive investor sentiment or news about the company’s expansion could also drive the price up.

1 thought on “waaree renewables share price target 2025 to 2030”

Comments are closed.